Capital Gains Tax Rules For 2025 - Capital Gains Tax Rules For 2025 Trudi Caritta, The higher your income, the more you will have to pay in capital gains taxes. Long Term Capital Gains Tax Rate 2025 Nys Kipp Seline, If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint.

Capital Gains Tax Rules For 2025 Trudi Caritta, The higher your income, the more you will have to pay in capital gains taxes.

Capital Gains Tax Rate 2025 Overview and Calculation, The irs may adjust the capital gains tax rate each year.

Capital Gains Tax Rules For 2025 Lonee Rafaela, The capital gains tax is a tax on any capital gains you make during a tax year.

Long Term Capital Gains Tax 2025 Lela Gwenore, Your 2025 capital gains bill will depend on 4 main things.

Capital Gains Tax Rules For 2025 Tommy Philippine, The indian government has relaxed new property tax rules it proposed just two weeks ago, after criticism that the changes added to an already heavy.

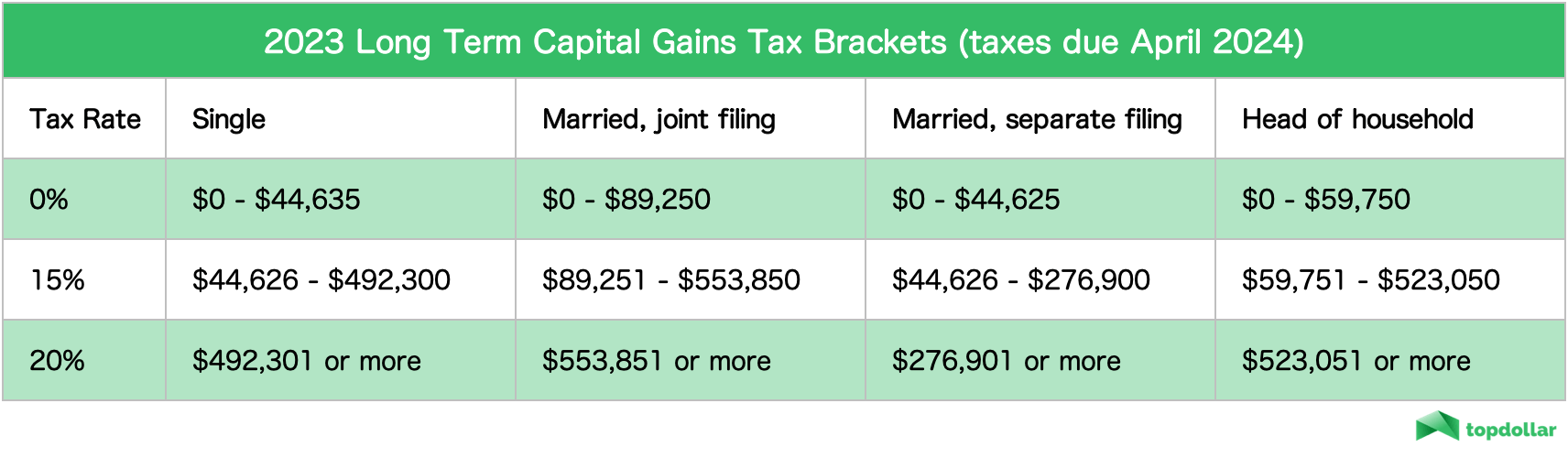

Long Term Capital Gains Tax Rate 2025 Irs Zaria Malory, Married couples filing jointly can get the 0%.

Capital Gains Tax On Farmland 2025 Lyndy Roobbie, Most taxpayers pay a maximum 15% rate, but a 20% tax rate applies if your taxable income.

2025 Capital Gains Tax Rate Calculator Grier Kathryn, In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.

Capital Gains Tax Rules For 2025. The capital gains tax is a tax on any capital gains you make during a tax year. If your taxable income is more than $518,900, you pay 20% on your long.

Capital Gains Tax Rules For 2025 Trudi Caritta, Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns.

2) how long you held the investments you. From hiking the standard deduction limit in the new tax regime to tweaking tax slabs to simplifying capital gains tax — budget 2025 has changed a host of tax rules that will.